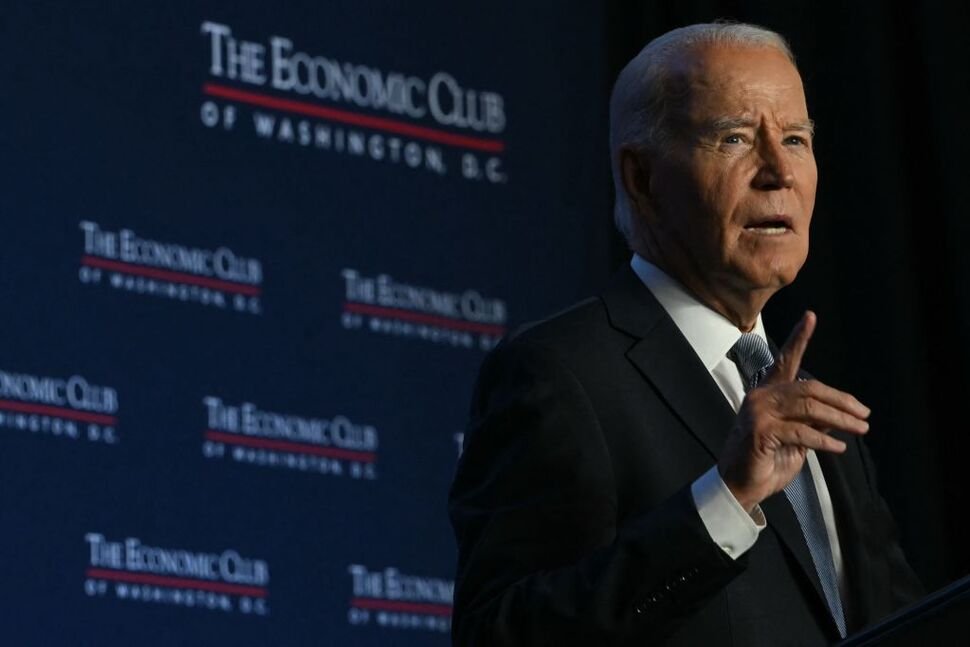

The president said it was not a victory lap, but it was certainly a reprise of his greatest hits.

President Joe Biden denied on Thursday that he was taking a victory lap one day after the Federal Reserve cut interest rates by a half point, saying inflation was licked and the economy remains strong.

But it sure sounded that way as the 46th president spoke to a gathering of the Economic Club of Washington, taking the audience on a trip through the economic history of the past three and a half years. Biden traced the economy’s state at the start of COVID-19, a time some compared to the Great Depression, to today when the U.S. economy is the envy of the world.

“Interest rates are going to begin coming down,” Biden said, referencing the Fed’s move on Wednesday, “and it’s expected to go further and that’s a good place to be.”

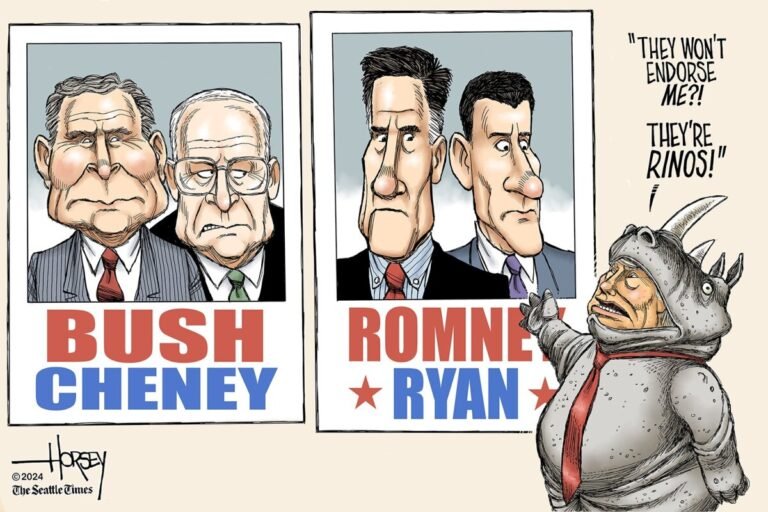

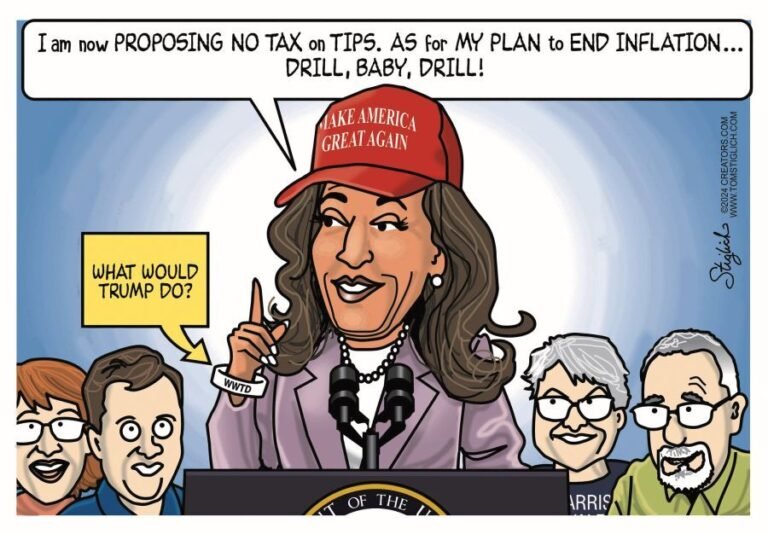

A faltering debate performance in July and lingering resentment over the spike in inflation that followed the COVID-19 pandemic led to Biden’s withdrawal from the presidential race. Vice President Kamala Harris is generally getting better marks than her boss on how she might handle the economy if she wins the White House. But former President Donald Trump still casts the economy in a bad light and his supporters overwhelmingly hold that view.

“I guess it shows the economy is very bad to cut it by that much, assuming they’re not just playing politics,” Trump said Wednesday in New York after the Fed lowered rates more than had been forecast. “The economy would be very bad, or they’re playing politics, one or the other. But it was a big cut.”

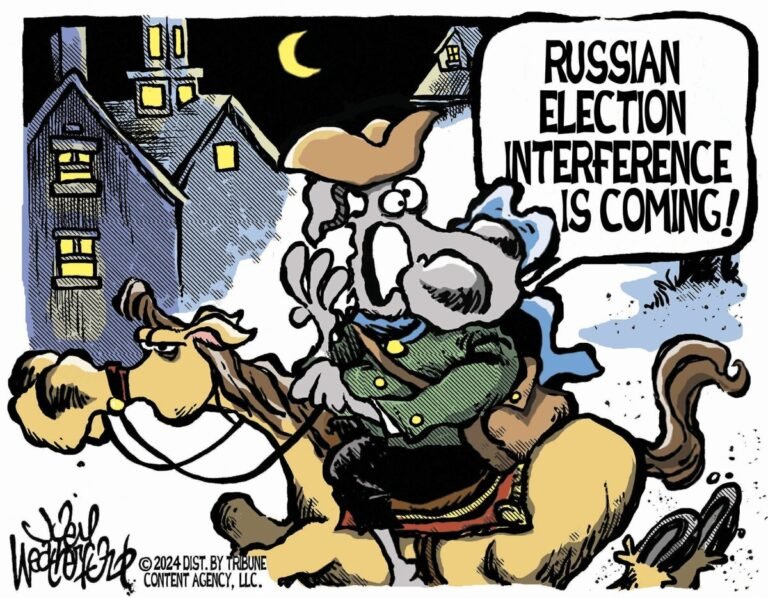

Biden linked the aftermath of the pandemic – with shipping lanes clogged, goods scarce and people shut in and working remotely – to the economic problems he faced. But he also blamed Russian President Vladimir Putin’s 2023 invasion of neighboring Ukraine for driving up energy prices, adding to inflation.

“By the way, our gas prices are now to $3.20, below where they were” before the Russian invasion, Biden said.

He also noted that many critics said his economic policies would increase unemployment and that a recession was inevitable, something many economists said as 2023 began. “Possible, but I refused to accept that,” he said.

He ran through some of the greatest victories: passage of the Chips and Science and Inflation Reduction Acts and reducing the cost of prescription drugs paid for by Medicare. He noted the 16 million jobs created during his term and the record number of working-age women with a job.

But he also made a point of contrasting his record with that of his predecessor, saying that Trump ballooned the deficit and ended his term in the White House with fewer jobs than he started.

Economic data currently paints the economy much better than Americans say it is, though polling follows partisan belief more than the real numbers. Economic growth is in the 2% and better annual range, unemployment is at 4.2% (a number that is close to what was once thought full employment), and the stock market has been setting new highs. Indeed, the Dow Jones Industrial Average was up more than 500 points as Biden took to the stage.

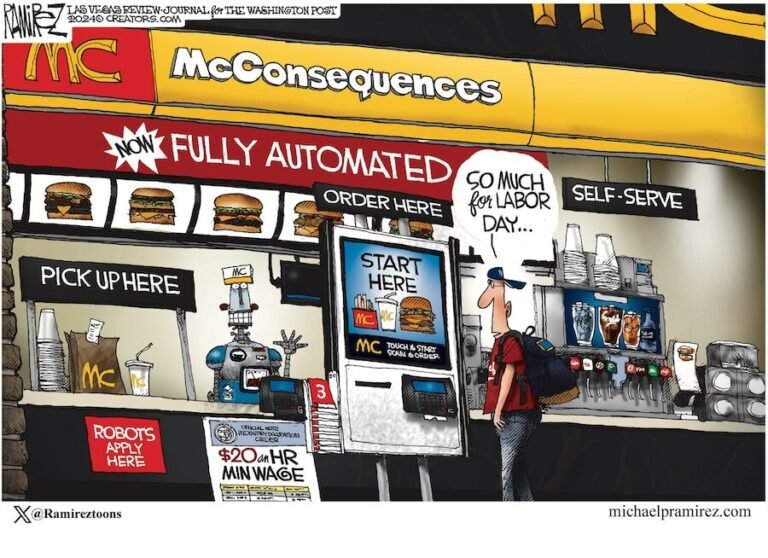

White House officials have said that the president had a three-pronged plan: to deal with COVID-19 problems he inherited when he took office, prioritize improving the lives of working Americans, and rebuild American manufacturing. He enjoyed some successes on those fronts, including passing legislation that included investments in domestic semiconductor manufacturing and electric vehicles. But he was unable to get out from under the scourge of inflation, which has only now come to levels that the Fed feels are acceptable. Higher prices on many items from groceries to shelter have frustrated Americans, many of whom grew up in a period of no to low inflation.

Those who own homes, and stocks or hold their spare money in savings and money market funds have seen their assets rise in value. Seniors have enjoyed higher-than-normal increases in Social Security payments. However, lower-income households have suffered from higher prices and borrowing costs, even as their wages have posted gains greater than inflation.

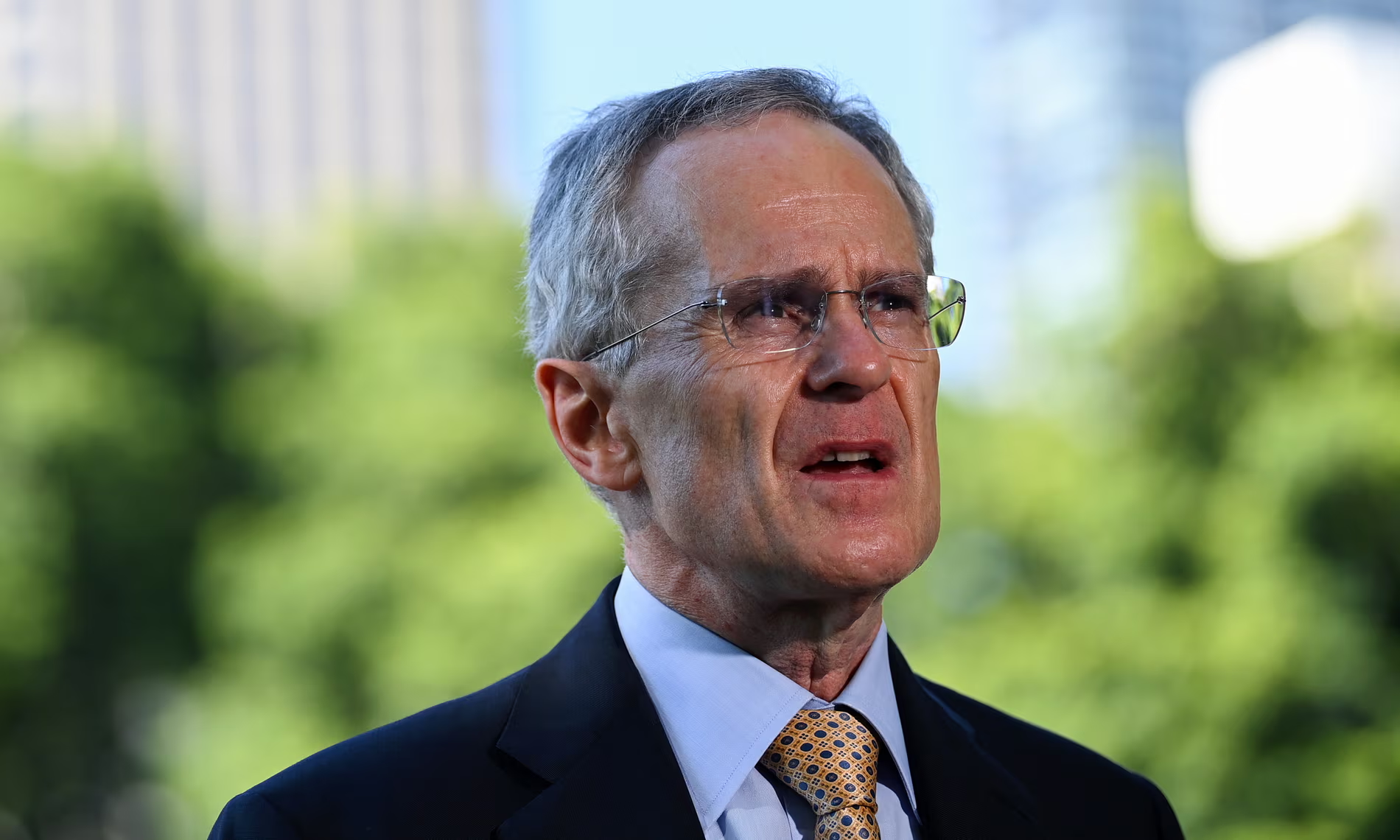

“I don’t see anything in the economy right now that suggests that the likelihood of a recession – sorry – of a downturn is elevated, OK? I don’t see that,” Fed Chairman Jerome Powell told reporters on Wednesday.

On Thursday, the National Association of Realtors said that existing home sales fell 2.5% in August and are down 4.2% from a year ago. The median price of a home sold, however, continued to climb, to $416,700 – a 3.1% increase from a year ago.

An index of leading economic indicators from the Conference Board declined by 0.2% in August 2024, following a 0.6% decline in July. For the last six months, the index fell by 2.3%, a rate of decline that was lower than the 2.7% drop in the prior six-month period.

“In August, the US LEI remained on a downward trajectory and posted its sixth consecutive monthly decline,” said Justyna Zabinska-LaMonica, senior manager, of business cycle indicators at the business organization. “The erosion continued to be driven by new orders, which recorded its lowest value since May 2023. A negative interest rate spread, persistently gloomy consumer expectations of future business conditions, and lower stock prices after the early-August financial market tumult also weighed on the Index.”

“Overall, the LEI continued to signal headwinds to economic growth ahead. The Conference Board expects US real GDP growth to lose momentum in the second half of this year as higher prices, elevated interest rates, and mounting debt erode domestic demand. However, in the Fed’s September 2024 Summary of Economic Projections, policymakers suggested 100 basis points of interest rate cuts are likely by the end of this year, which should lower borrowing costs and support stronger economic activity in 2025.”

Leave a Reply