Americans became more optimistic about the economy in August, although there were some concerns about the labor market.

Key Takeaways:

- Consumers felt better about the economy in August.

- Expectations for inflation a year from now eased slightly.

Consumer confidence improved slightly in August as Americans balanced more optimism about the economy’s prospects while also exhibiting worries about the labor market.

The consumer confidence index from the Conference Board rose to 103.3 while the reading for July was revised upward to 101.9 from 100.3 previously. Both the present situation and future expectations indices improved.

“Consumers’ assessments of the current labor situation, while still positive, continued to weaken, and assessments of the labor market going forward were more pessimistic,” Peterson added. “This likely reflects the recent increase in unemployment. Consumers were also a bit less positive about future income.”

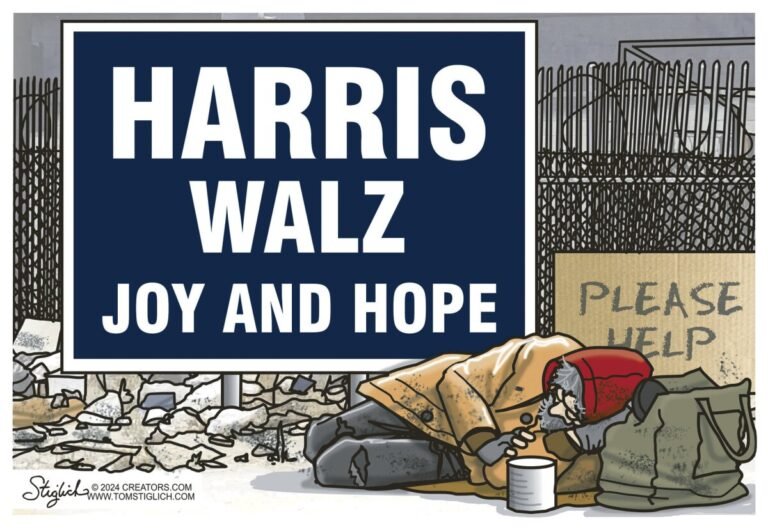

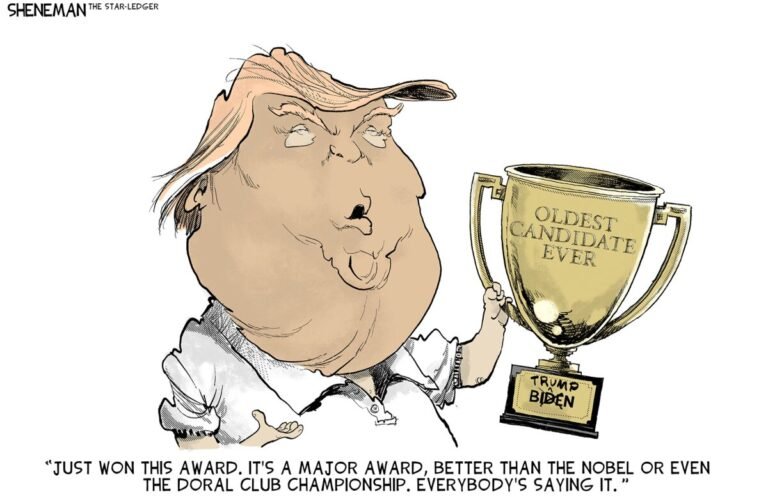

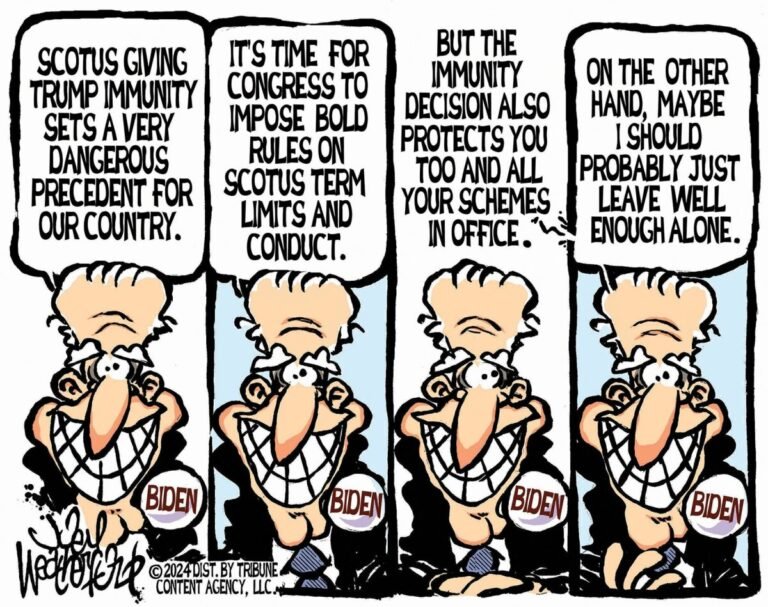

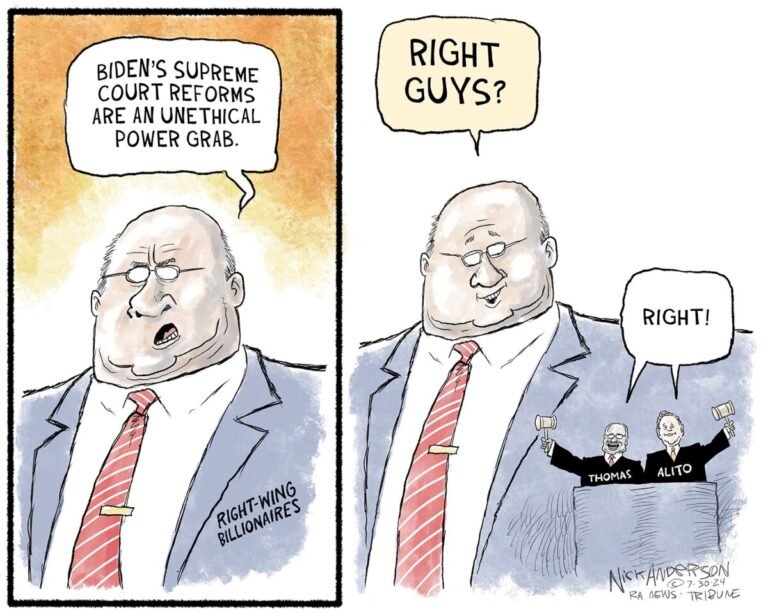

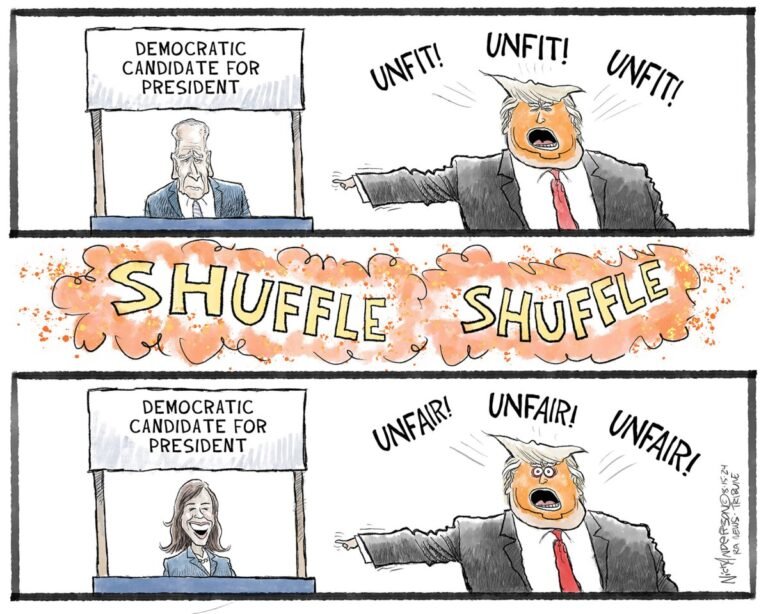

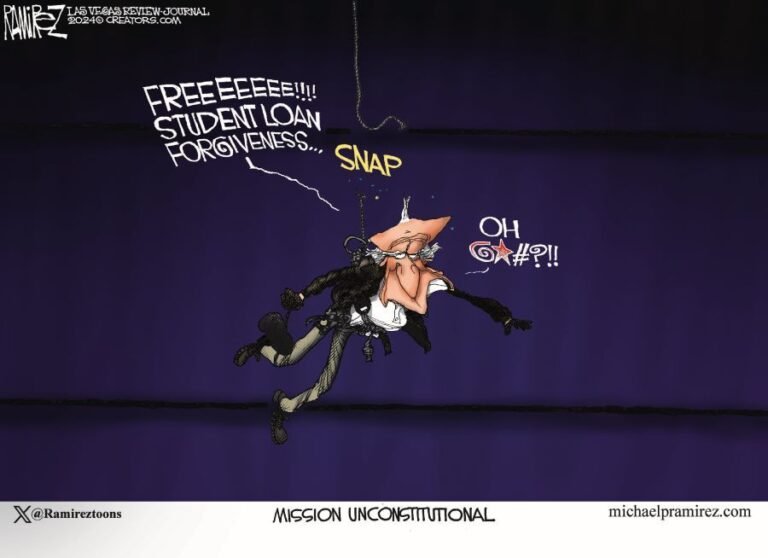

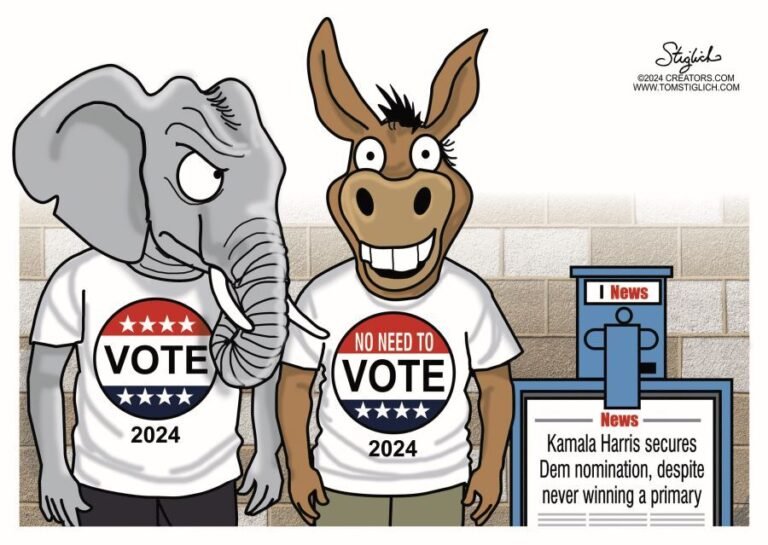

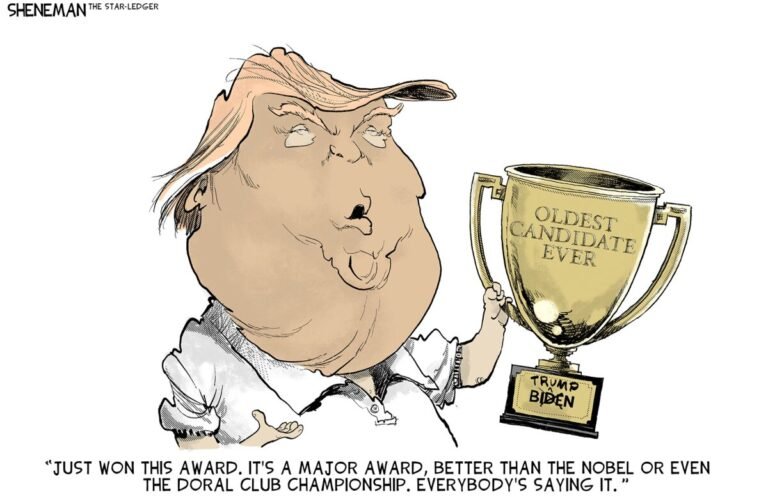

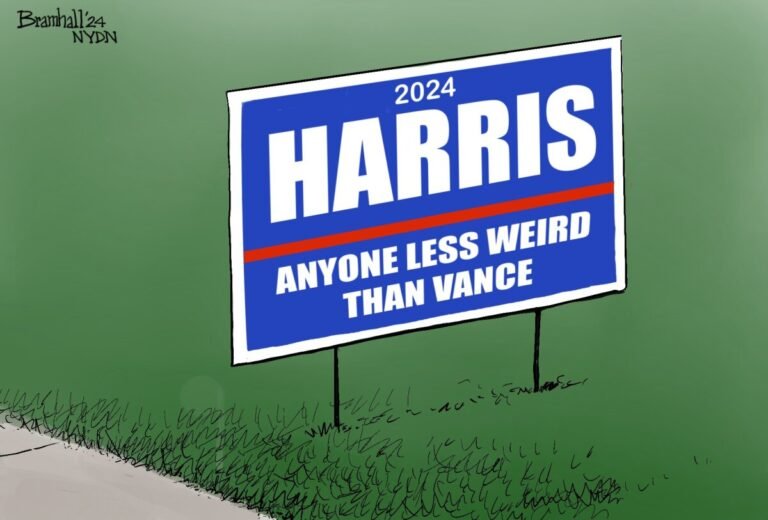

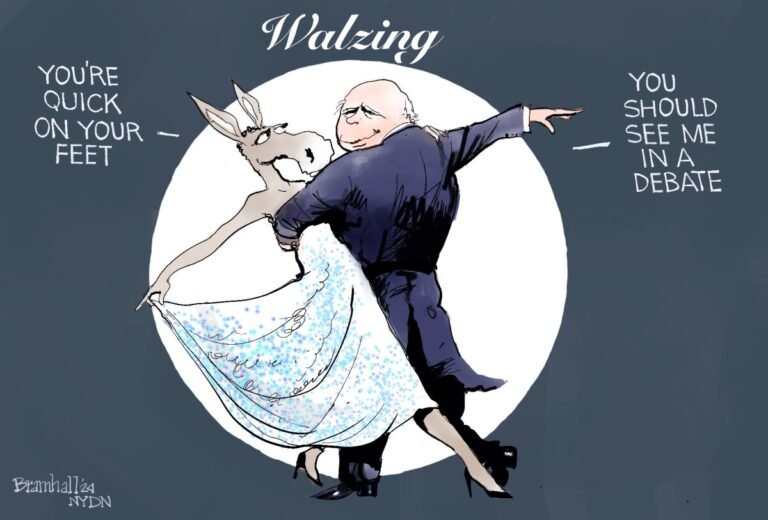

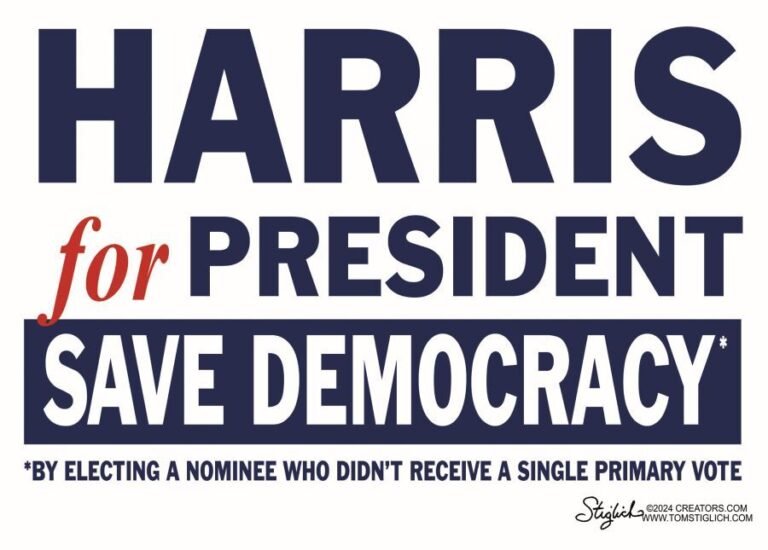

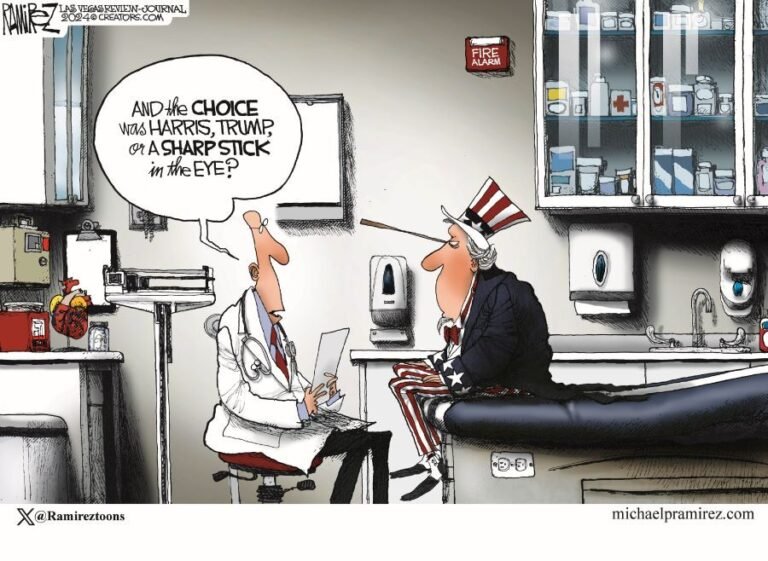

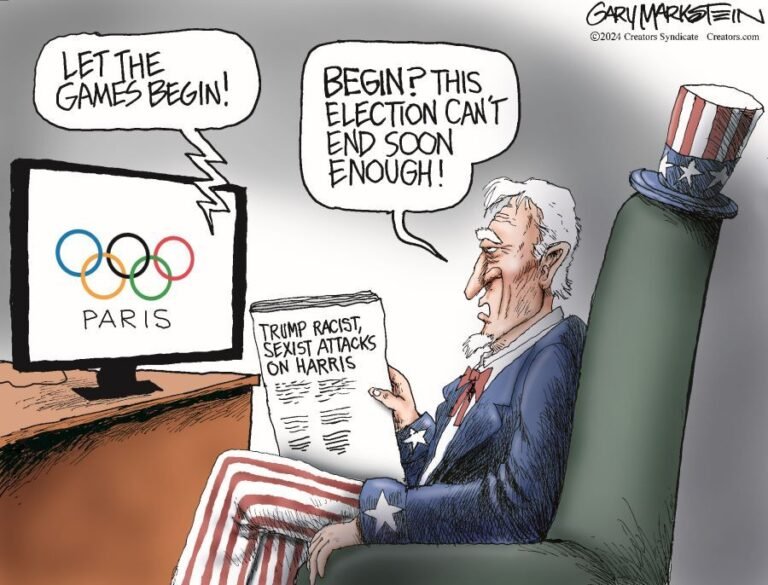

The report comes at an important time for the economy, with the Federal Reserve set to begin lowering interest rates at its meeting next month. And it comes as the 2024 presidential election heats up with both Vice President Kamala Harris and former President Donald Trump targeting the economy, though each is proposing quite different ideas on the topic.

The index continues to show differing perspectives depending on the age and income of the respondents.

“In August, confidence declined among consumers under 35 while it increased for those 35 and older,” Peterson said. “On a six-month moving average basis, confidence remained the highest among young consumers. Despite the overall improvement in the headline Index, confidence declined for consumers earning less than $25K. On a six-month moving average basis, consumers earning over $100K remained the most confident. Confidence among consumers earning $15K to $24.9K continued to trend down and was almost as low as for those earning less than $15K.”

Inflation expectations fell slightly, with consumers believing prices will rise over the next year at a 4.9% rate – well above the current 2.9% level as indicated by July’s consumer price index. Still, the number is the lowest since March 2020 when COVID-19 set off a sharp increase in prices.

Interestingly, although many surveys of consumers over the past couple of years have shown distinct differences based on political persuasion, “In August write-in responses, the share of respondents believing the 2024 elections would impact the economy was stable, at slightly above 2020 levels – but well below the August 2016 level.”

EY Chief Economist Gregory Daco said the early August volatility in the stock market is not changing the behavior of consumers and, indeed, the Dow Jones Industrial Average posted a new high on Monday.

“Business leaders and consumers are not retrenching and financial market volatility is more a reflection of the Federal Reserve being behind the curve in terms of easing policy than reflective of any fundamental economic weakness,” Daco said. “This is positive as Fed policy easing in the coming months should support the economy and reduce financial market volatility. We foresee real GDP growth averaging 2.5% in 2024, and easing to 1.7% in 2025.”

Separately, the S&P CoreLogic Case Shiller national home price index reached a new high in June after a 5.4% rate of annual increase. That rise was slightly below the 5.9% a month earlier, however.

New York posted the highest gain, at 9% year over year, with San Diego at 8.7% and Las Vegas following at 8.5%.

The housing market is being affected by high prices, limited inventory, and elevated mortgage rates, though those have dipped slightly in recent weeks as the Fed signals that it will be cutting interest rates soon.

“We expect the rate of home price growth to slow somewhat further,” said Realtor.com Chief Economist Danielle Hale. “The Realtor.com 2024 forecast update projects growth of just 4.6% for the year. Even though the number of homes on the market for sale trails 2017 to 2019 levels by 30%, the number of home sales has remained quite low.”

“In the face of sluggish demand, today’s low but quickly improving for-sale inventory has ushered in more market balance than would otherwise be expected, pushing up the share of sellers making price cuts, according to Realtor.com data. This should help home prices maintain a slower pace of growth.”

Leave a Reply