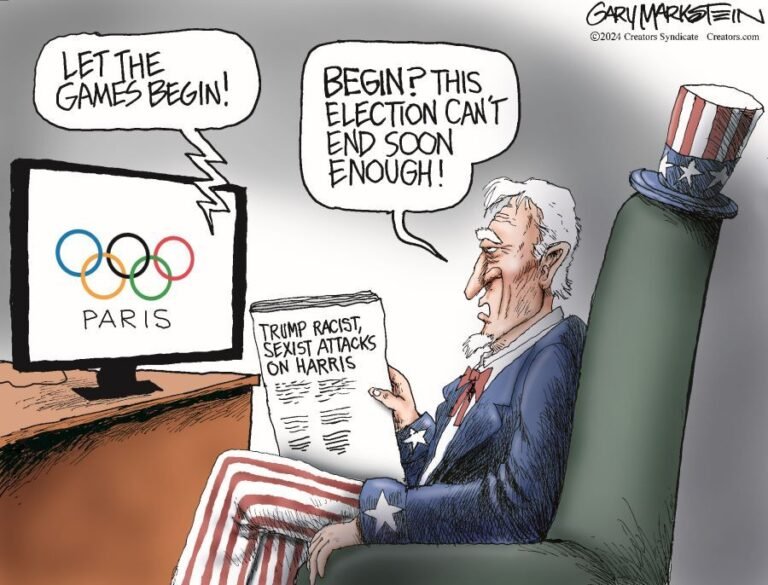

The Democratic National Convention starts in Chicago, while the week ends with an important Federal Reserve gathering in Jackson Hole.

Democratic presidential nominee Vice President Kamala Harris, right, and second gentleman Doug Emhoff greet supporters upon arriving at Pittsburgh International Airport, Sunday, Aug. 18, 2024, in Pittsburgh.

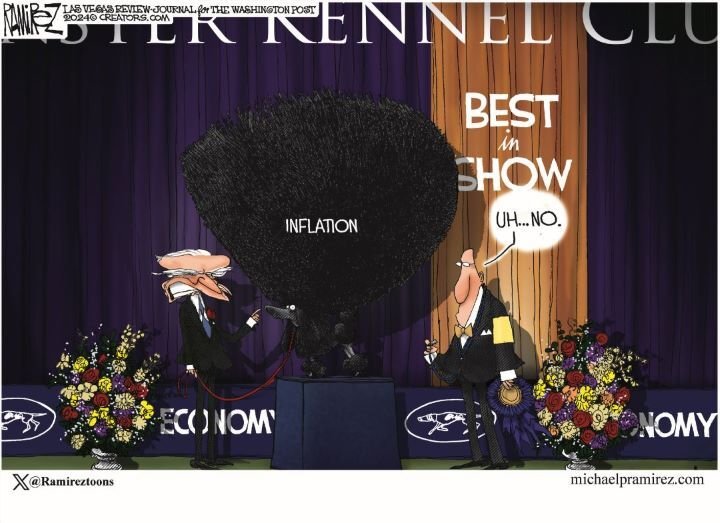

Two years ago, Federal Reserve Chairman Jerome Powell told America that interest rate hikes starting in June 2022 were just the beginning of a campaign against inflation that had peaked at 9.1%.

His speech at Jackson Hole, Wyoming, during the Fed’s summer research symposium warned that the sharp increase in interest rates would slow economic growth, weaken unemployment, and “also bring some pain to households and businesses.”

“We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored,” Powell said. “We will keep at it until we are confident the job is done.”

Last month, the Fed kept interest rates at their highest levels since 2002 but also suggested that it considers the job done. So, this Friday, when Powell speaks with the awe-inspiring vista of the Grand Tetons as background, markets, and consumers will be waiting alike to declare victory in some fashion.

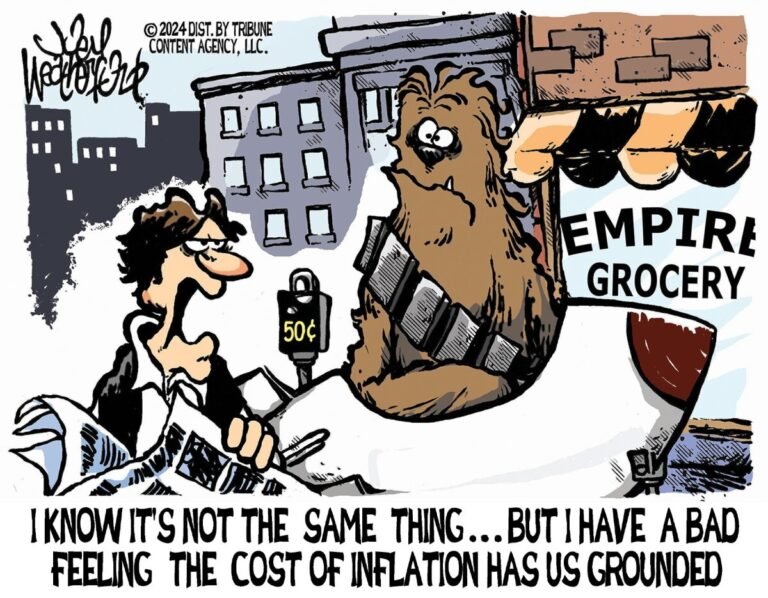

Market odds strongly favor an interest rate cut in September, and last week may have provided the last bit of confidence to Powell and his colleagues. The consumer price index for July came in at an annualized pace of 2.9% – not exactly the 2% the Fed targets – but under 3% and headed downward. At the same time, positive reports on consumer spending and sentiment helped the S&P 500 index register its best week of the year.

“We suspect Chair Powell could use this week’s event to take the next step towards a rate cut by suggesting that, amid the evolution of the economy over the past year, the increasingly restrictive stance of policy, when viewed through the lens of the real fed funds rate, may no longer be appropriate,” said Sam Bullard, managing director, and senior economist at Wells Fargo’s corporate and investment banking group.

“With economic growth still strong and inflation not fully snuffed out, we would expect Powell to suggest that any easing at this juncture would be a dialing-back of policy restriction, with the policy setting normalizing alongside economic conditions,” Bullard added. “While his speech is likely to hint that a rate cut is coming as soon as the FOMC’s next meeting, we expect him to stop short of offering any clues as to the size of a potential rate adjustment,” with fresh economic data on the labor market and inflation to be available ahead of the Fed’s next meeting.

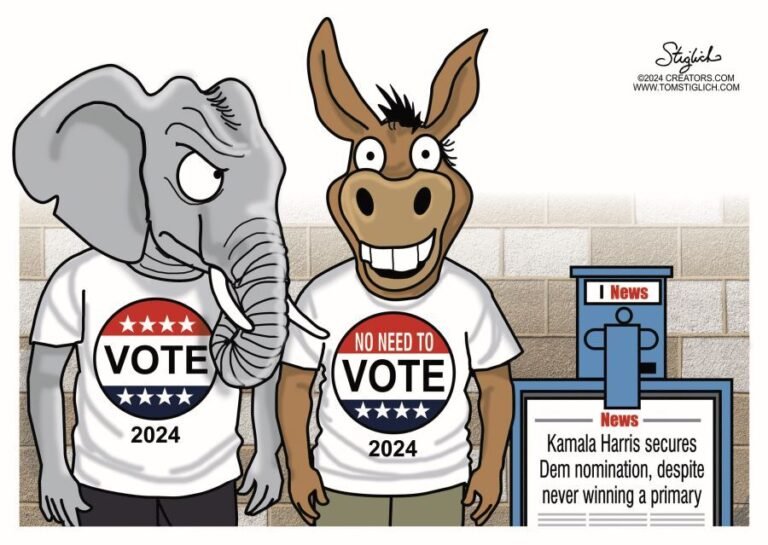

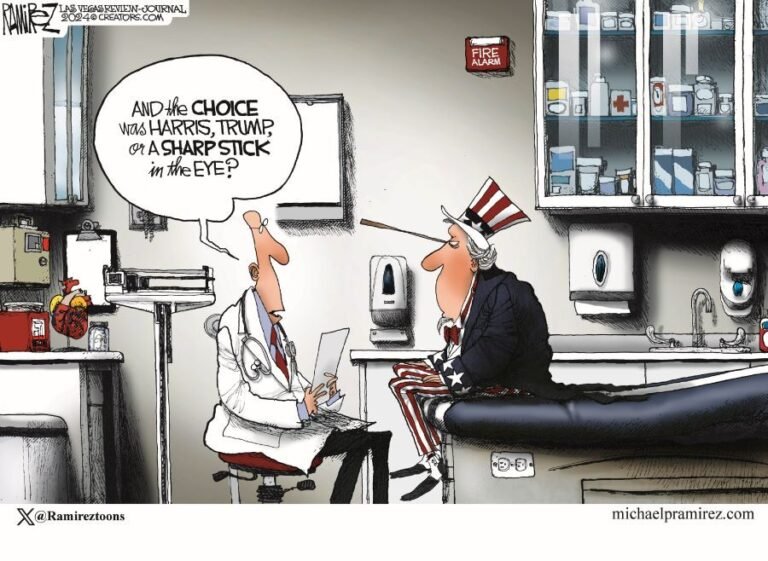

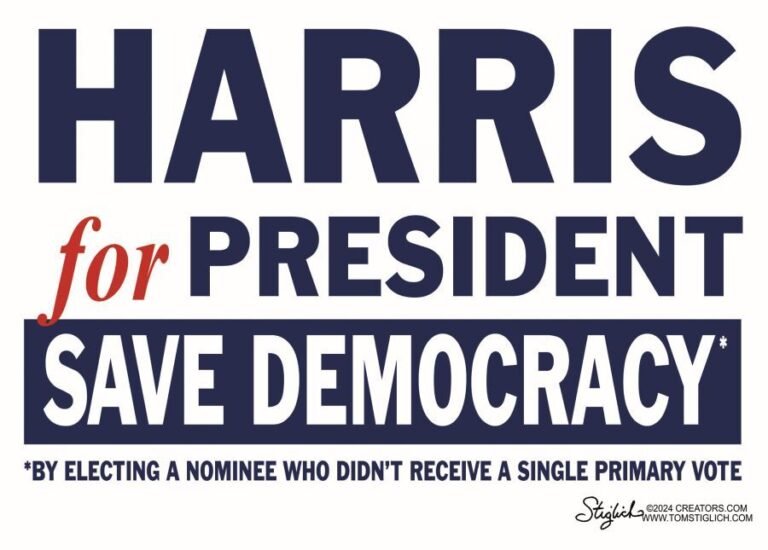

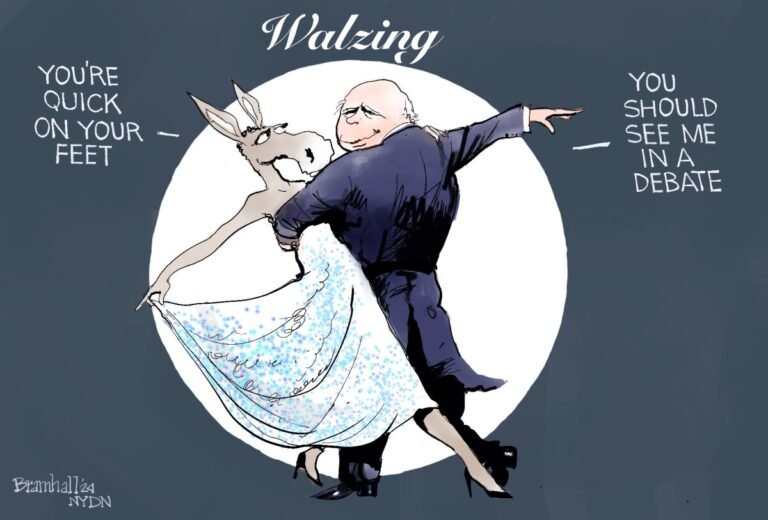

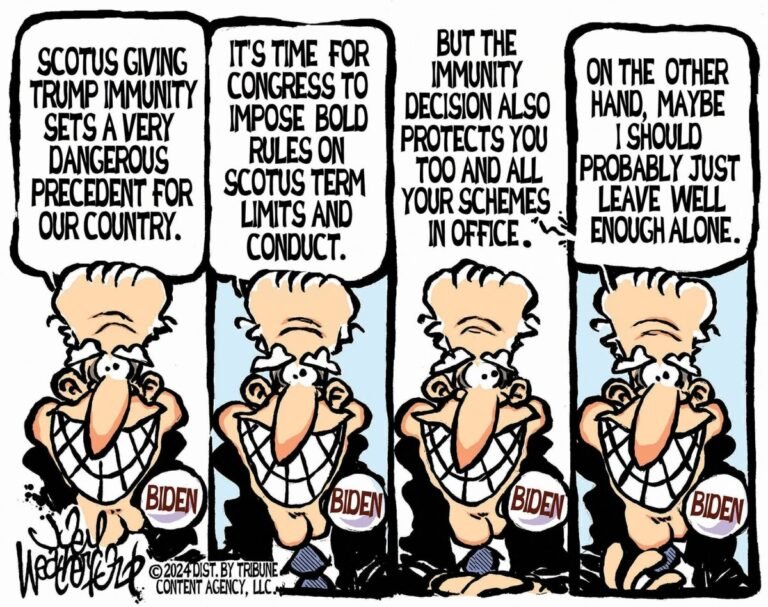

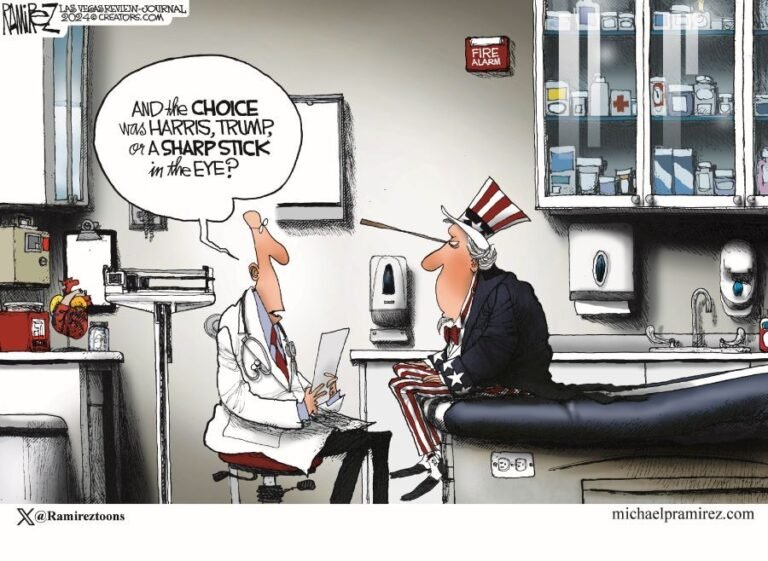

Before the Fed’s week-ending drama, however, there is the matter of a presidential election that is now 77 days away. Democrats gather in Chicago beginning Monday when President Joe Biden is expected to give a farewell of sorts since dropping out of the race in July. Vice President Kamala Harris will be formally chosen as the party’s presidential nominee and will close out the convention on Thursday.

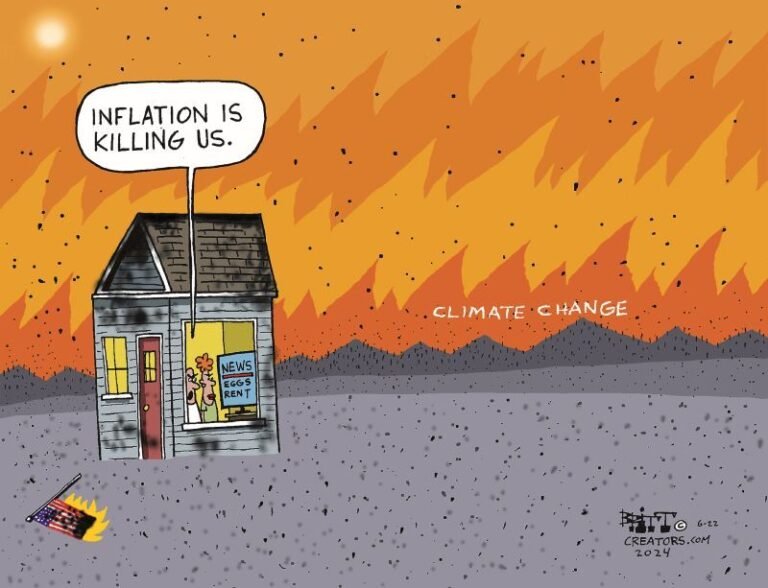

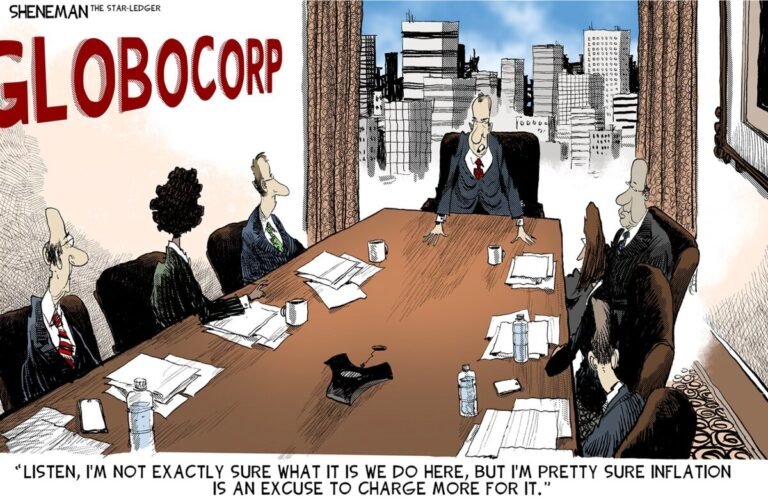

Harris has recently begun speaking out about the economy, laying out an ambitious agenda focused on making housing, child care, and buying groceries more affordable.

The proposals were introduced at a campaign event in North Carolina – a swing state that Democrats hope to flip after former President Donald Trump won it by a thin margin in 2020 – and include policies aimed at housing affordability, childcare costs, medical debt, and inflation.

They include a $25,000 incentive for first-time homebuyers, a $6,000 tax credit per child for families during the first year of a baby’s life, eliminating medical debt, a ban on price gouging for groceries, a cap on prescription drugs, and cutting red tape.

“Building up the middle class will be a defining goal of my presidency,” she said. “I strongly believe when the middle class is strong, America is strong.”

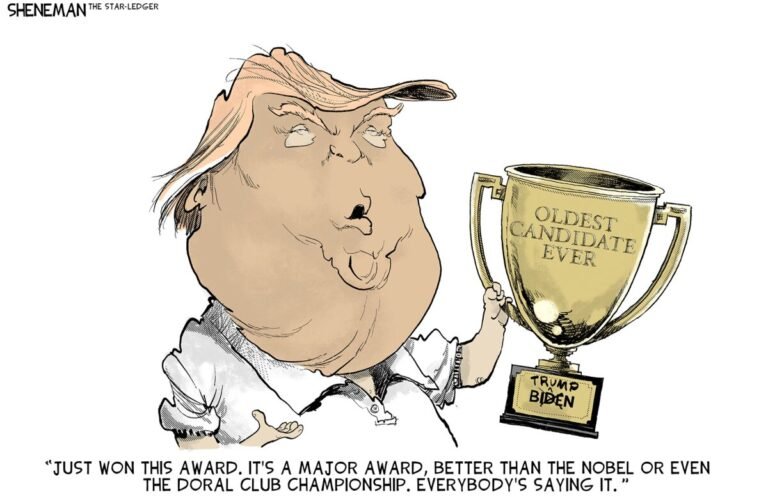

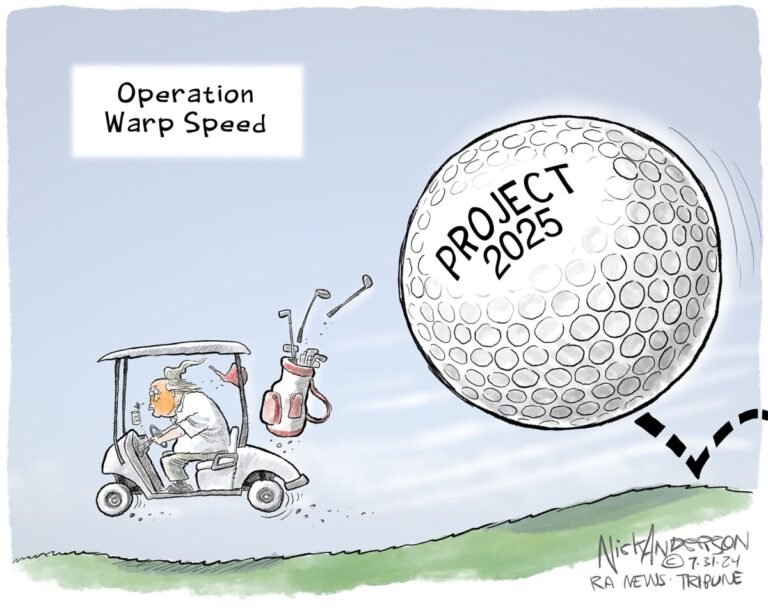

Not to be outdone, former President Donald Trump has injected more commentary about the economy into his common campaign staples of threatening mass deportations of immigrants and cleansing the federal government of employees who are not loyal to his administration’s policies.

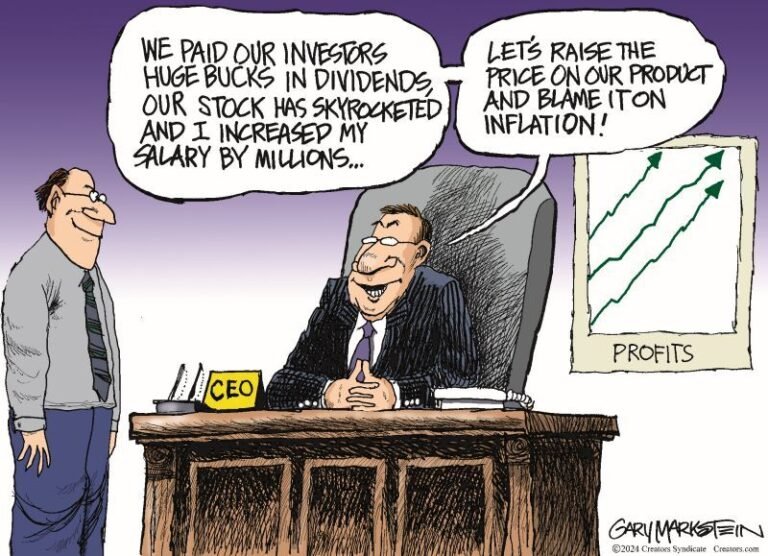

On Saturday in Pennsylvania, Trump brought up his plan to increase and broaden tariffs on imported goods – claiming, as he has back to his first term, that they are taxes paid by the countries that export their goods to the U.S. and not by American consumers.

“In her speech yesterday, Kamala went full communist,” he said. “Comrade Kamala announced that she wants to institute socialist price controls. You saw that never worked before. … It will cause rationing, hunger, and skyrocketing prices.”

And he has stepped up his name-calling of Harris, criticizing her laugh and saying he is better looking than her. Harris currently has a slight edge in national polls, while also polling just a tad ahead of Trump on the economy.

The coming week does provide some economic data, July’s leading economic index on Monday, along with reports on existing and new home sales on Thursday and Friday. Home sales should be up slightly while the leading index is expected to show a decline, although it is currently not signaling an imminent recession.

Leave a Reply