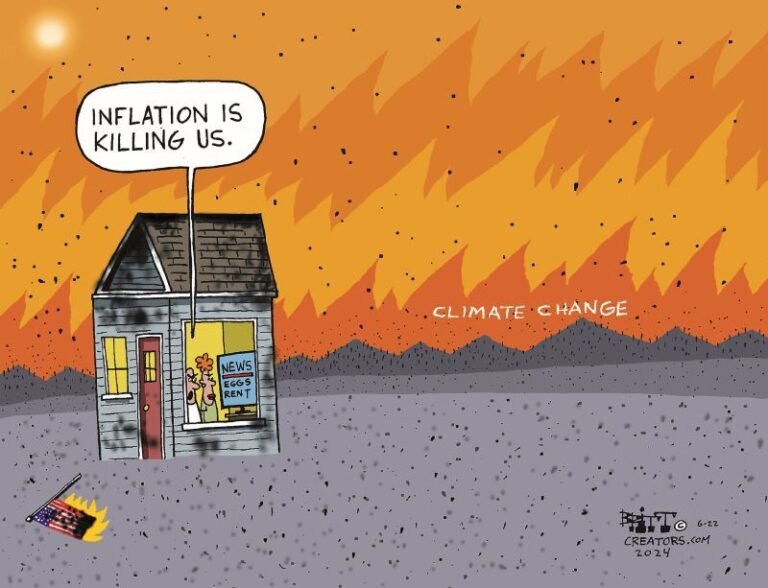

A key measure of inflation met analysts’ expectations as markets predict an interest rate cut in September.

A shopper peruses cheese offerings at a Target store, Oct. 4, 2023, in Sheridan, Colo.

Key Takeaways:

- Inflation continues to moderate, with the annual level dropping to 2.5% from 2.6% in May.

- The easing has markets pricing in a September cut in interest rates from the Federal Reserve.

Inflation eased slightly in June, coming in at forecast as markets pencil in a September interest rate cut just ahead of the pivotal presidential election.

The personal consumption price expenditures index did rise by 0.1%, in line with estimates, but the annual rate edged down to 2.5% from 2.6% in May. The core index, leaving out volatile energy and food costs, was higher, at 0.2% for the month after May’s 0.1% increase. But the annual core rate was unchanged at 2.6%.

The PCE report comes a day after U.S. gross domestic product for the second quarter was estimated at an annual level of 2.8% – double that of the first quarter and well above forecasts. Increased spending by consumers and greater business investment helped drive the gain.

PCE is not as commonly known as the consumer price index but is followed closely by the Federal Reserve because it is seen as more sensitive to short-term price moves.

The Fed meets next week, but most experts believe it will leave interest rates unchanged, opting instead to make its first cut in September. While the trajectory of inflation has been downward, price levels are still above the 2% annual target set by the Fed.

Although July is likely off the table for a cut, “September and December are live meetings” where a cut could happen, says Erik Aarts, senior fixed income strategist for Touchstone Investments. “But anything more than an incremental cut means something has changed” in the economic outlook.

Friday’s report showed that consumer spending increased by 0.3% while personal income rose by 0.2%. Markets rallied on the news, with Dow Jones Industrial Average futures up 225 points.

“Spending is good enough to maintain the expansion, and income is good enough to maintain spending,” said Robert Frick, corporate economist at Navy Federal Credit Union. “And the level of PCE inflation is good enough to make the decision to cut rates easy for the Fed. The one worrying number is the low savings rate, showing how many Americans are living on the margin.”

Next week brings the latest key report on the state of the economy with the July jobs number from the Labor Department. Expectations are for a gain of around 175,000. A cooling job market is something the Fed is looking for to help with inflation.

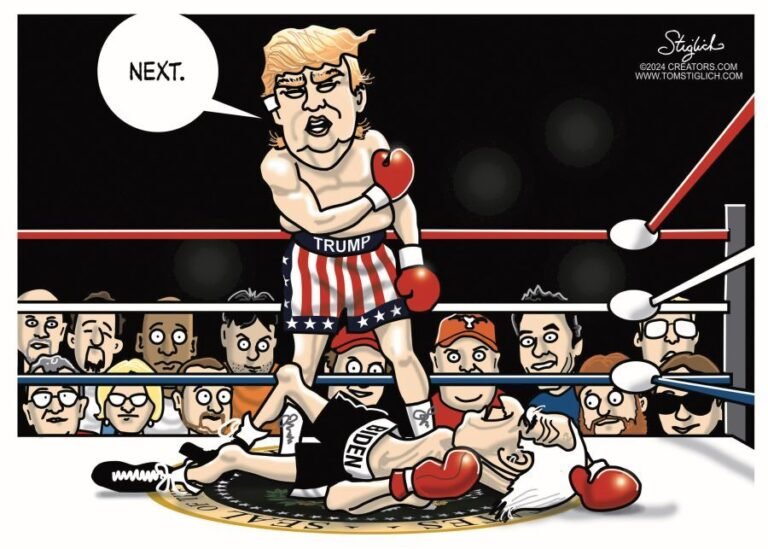

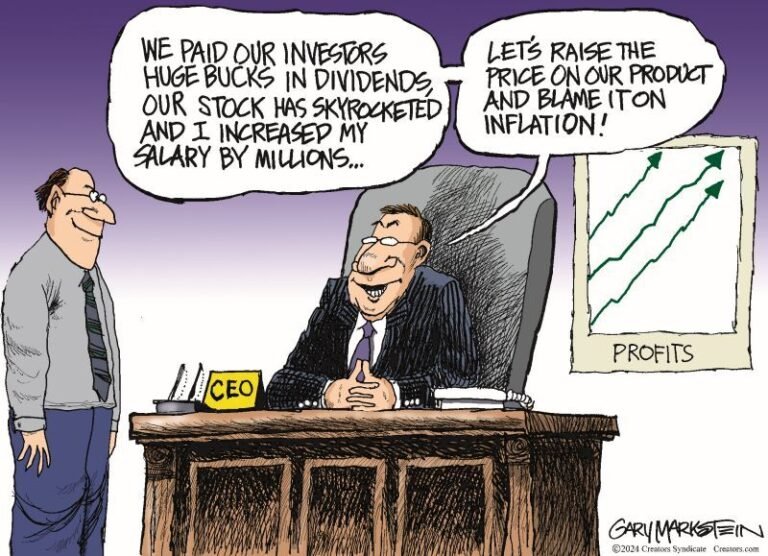

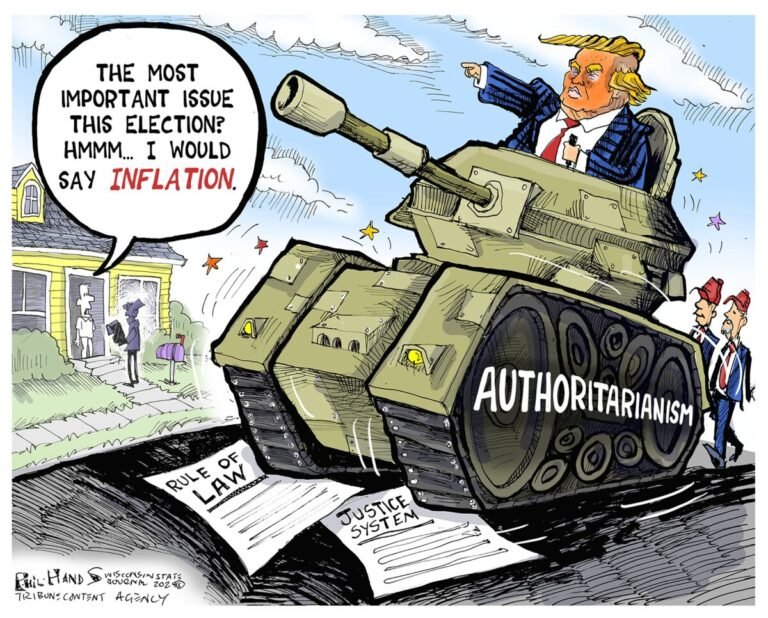

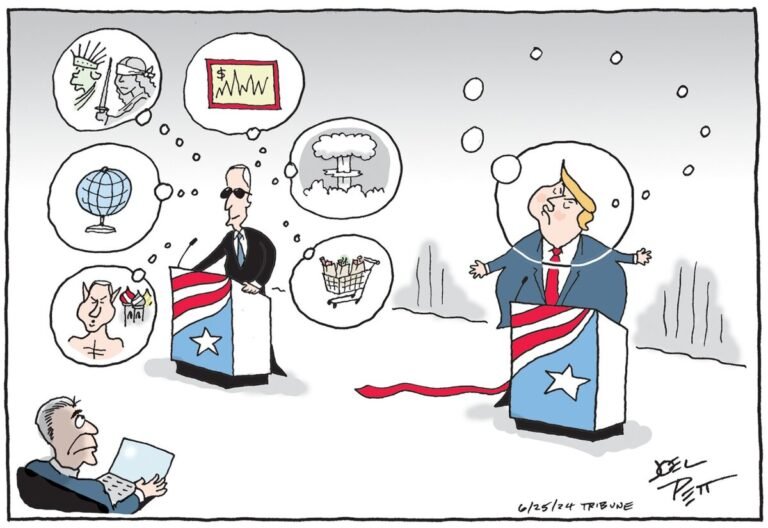

Inflation has been the Achilles’ heel of Joe Biden’s presidency, undercutting what has otherwise been a remarkable three years for the economy with steady growth, a robust labor market and income gains. Although the pace of price increases has subsided substantially – especially for key items like groceries, autos and gasoline – the cumulative effect of multiple years of high inflation has left consumers in a sour mood.

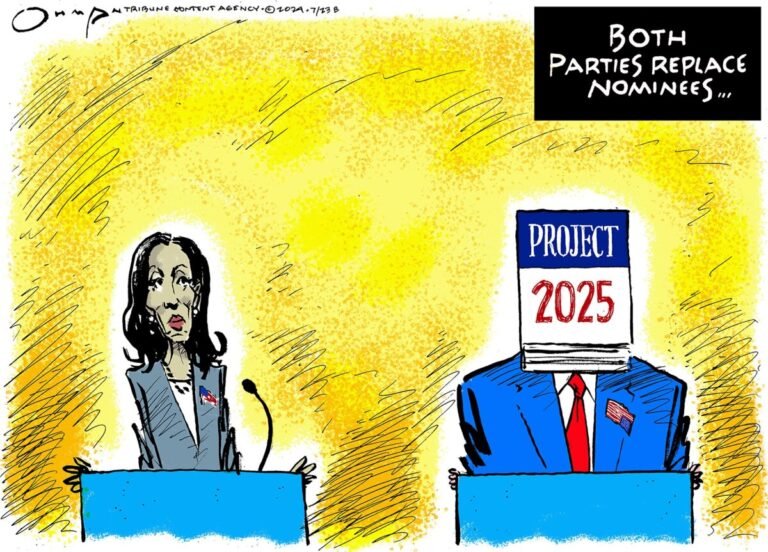

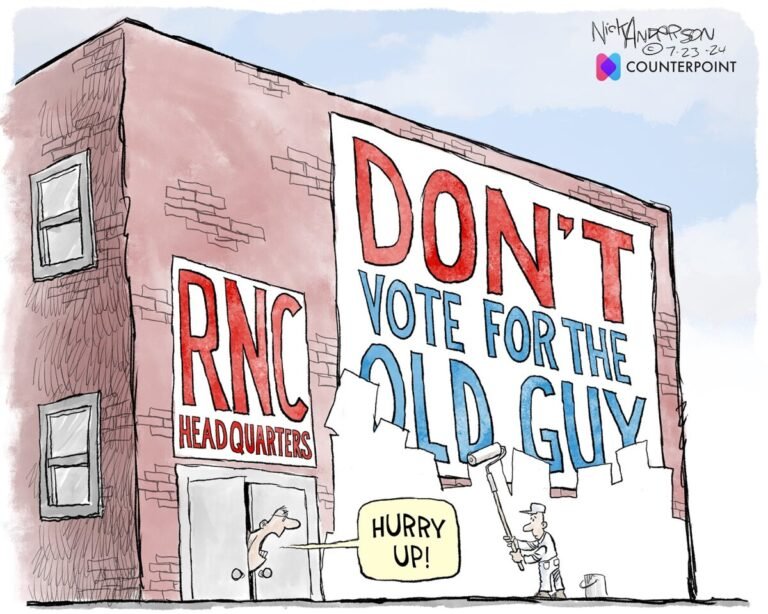

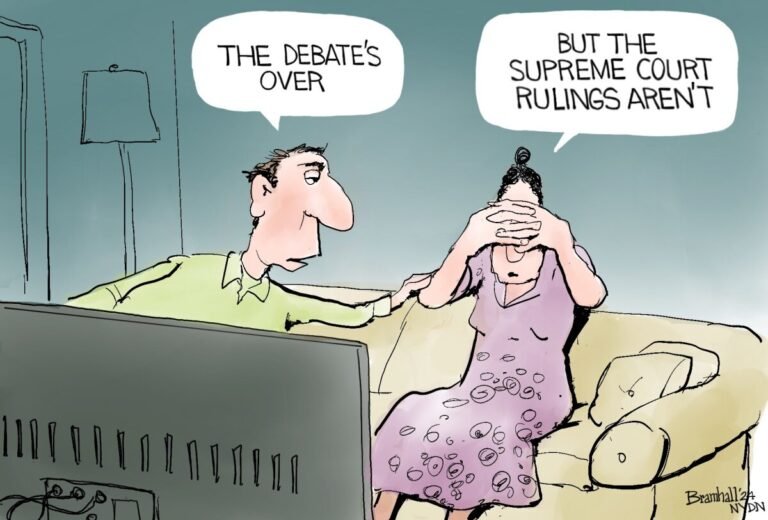

Saturday marks 100 days to the presidential election and uncertainty around the outcome – heightened by Biden’s withdrawal from the race – has left consumers cautious and businesses holding steady on their hiring and investment plans.

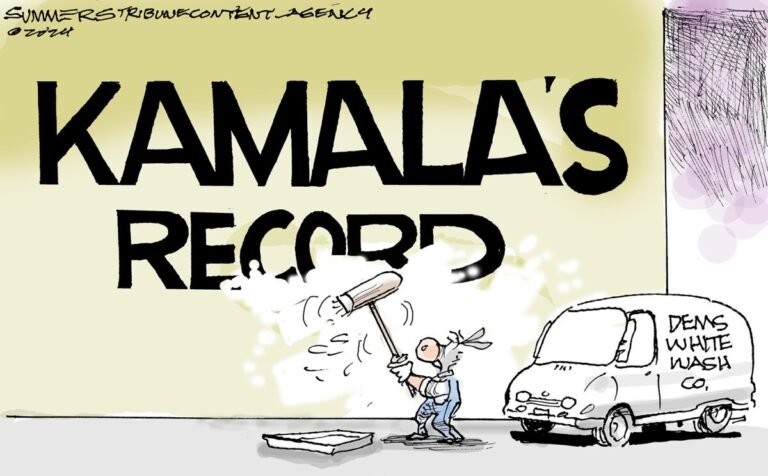

Vice President Kamala Harris is fairly unknown when it comes to specific economic policies she would follow if elected and how they would differ from those of Biden. But she has been emphasizing topics such as child care and paid family leave on the campaign trail. Those were part of the Biden economic agenda but took a back seat to actions like expanding domestic manufacturing and infrastructure amid opposition in Congress.

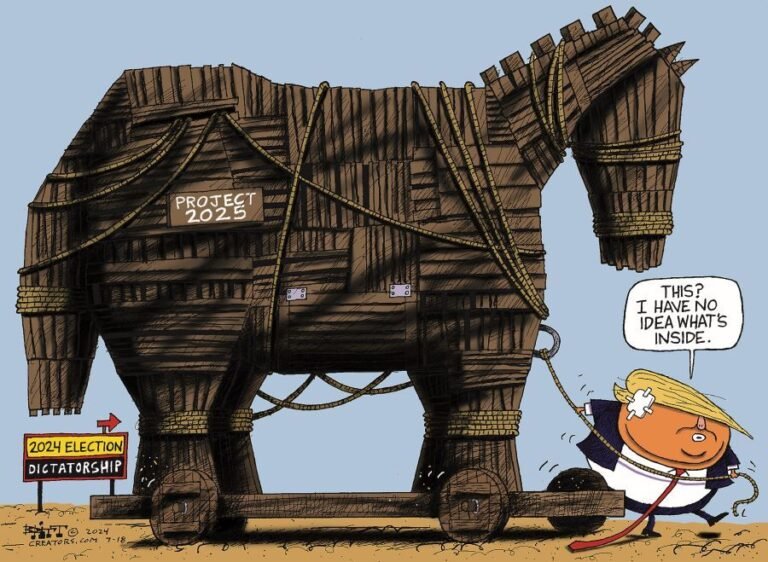

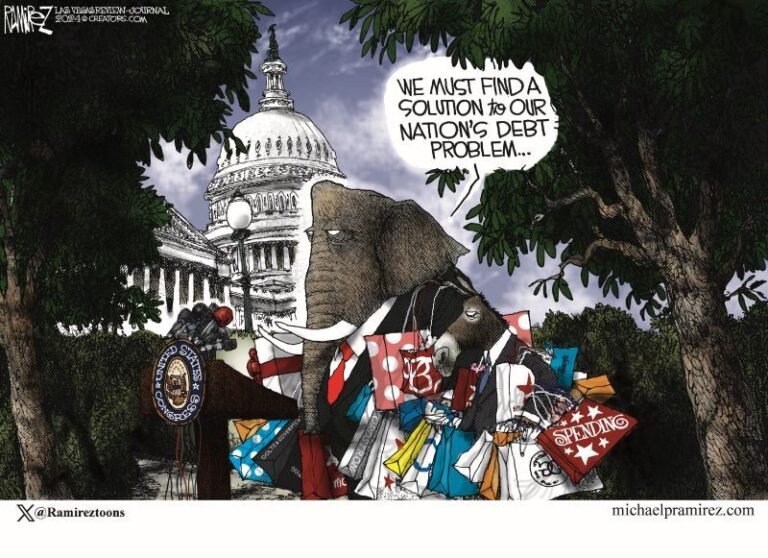

Former President Donald Trump, meanwhile, is promising a reprise of his tax cut and deregulation agenda that formed the main economic achievements of his first term, while also saying he wants to begin mass deportations of immigrants who may be in the U.S. illegally. Most economists believe that could lead to labor market tightness and rising inflation.

“Neither candidate seems particularly concerned about rising debts and deficits, and with deficits running at greater than 5% of GDP for the near term, we should expect (bond) yields to be more volatile and trend slightly higher than might otherwise be the case; however, the risk of this is likely to be higher under a Trump presidency, and more so with a united Congress,” said Richard de Chazal, macro analyst for William Blair.

Leave a Reply